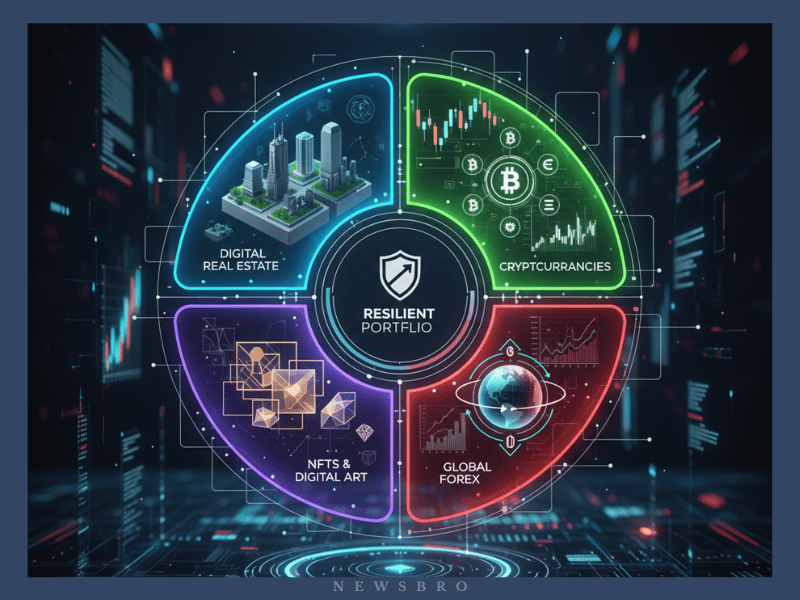

In today’s fast-paced, tech-driven economy, asset diversification has evolved far beyond traditional stocks and bonds. The digital world offers a vast array of opportunities for investors to build resilient portfolios that can withstand market volatility and capitalize on emerging trends. Whether you’re a seasoned investor or just beginning to explore financial strategies, understanding how to diversify assets in a digital landscape is essential for long-term success. This guide explores the key categories of digital asset diversification, the risks and rewards associated with each, and how to build a balanced strategy that aligns with your financial goals.

Digital Real Estate: The New Frontier

Digital real estate is quickly becoming a popular asset class, especially with the rise of virtual worlds and metaverse platforms. Investors can purchase virtual land, develop digital properties, and monetize them through advertising, events, or leasing. Platforms like Decentraland and The Sandbox have created thriving ecosystems where digital real estate is bought and sold much like physical property.

While speculative, digital real estate offers high upside potential for early adopters. However, it’s crucial to research platform stability, user engagement, and long-term viability before investing. As with any asset, diversification within this category—across platforms and use cases—can help mitigate risk.

Cryptocurrencies and Tokenized Assets

Cryptocurrencies remain a cornerstone of digital asset diversification. Bitcoin and Ethereum are the most well-known, but thousands of altcoins offer exposure to different sectors, technologies, and communities. Tokenized assets, such as stablecoins and security tokens, provide additional options for investors seeking lower volatility or regulatory compliance. The key to successful crypto investing lies in understanding the underlying technology and market dynamics. Diversifying across different types of tokens—utility, governance, and asset-backed—can help balance risk and reward. It’s also wise to allocate only a portion of your portfolio to crypto, given its inherent volatility.

Alternative Digital Investments: NFTs and Beyond

Non-fungible tokens (NFTs) have expanded the definition of digital assets, offering ownership of unique digital items such as art, music, and collectibles. While the NFT market has experienced fluctuations, it continues to attract creators and collectors alike. Beyond art, NFTs are being used in gaming, ticketing, and intellectual property management. Investors interested in NFTs should focus on projects with strong communities, clear utility, and transparent development roadmaps. As with other digital assets, diversification is key—consider spreading investments across different NFT categories and platforms to reduce exposure to any single trend.

Global Markets and Forex Trading

In addition to digital-native assets, global financial markets remain a vital part of a diversified portfolio. Forex trading, or foreign exchange trading, allows investors to speculate on currency movements and hedge against geopolitical risks. In the digital age, forex platforms have become more accessible, offering real-time data, automated trading tools, and educational resources. Forex trading can complement digital asset strategies by providing liquidity and exposure to macroeconomic trends. However, it requires a solid understanding of global economics, technical analysis, and risk management. As with all asset classes, it’s important to approach forex with a disciplined strategy and avoid overleveraging.

Building a Balanced Digital Portfolio

Diversifying assets in a digital world requires a thoughtful approach that balances innovation with stability. Here are a few guiding principles:

- Risk Allocation: Assign different levels of risk to each asset class. For example, cryptocurrencies may represent high risk, while tokenized bonds or stablecoins offer lower risk.

- Platform Selection: Choose reputable platforms with strong security, user support, and regulatory compliance.

- Continuous Learning: Stay informed about emerging technologies, market trends, and regulatory changes.

- Liquidity Planning: Ensure that a portion of your portfolio remains liquid to take advantage of new opportunities or cover unexpected expenses.

By combining traditional financial wisdom with digital innovation, investors can create portfolios that are both resilient and forward-looking.

Conclusion

The digital world has transformed the way we think about asset diversification. From virtual real estate and cryptocurrencies to NFTs and global forex markets, the opportunities are vast and varied. Success in this landscape requires not only curiosity and adaptability but also a strategic mindset grounded in research and risk management. As technology continues to reshape financial ecosystems, those who embrace diversification in its modern form will be better positioned to thrive.